Page 8 - the Noise October 2016

P. 8

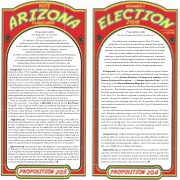

Proposition 205:

The Regulation & Taxation

of Marijuana Act

(1) establishes a 15% tax on retail marijuana sales, from

which the revenue will be allocated to public health & education;

(2) allows adults 21 years of age and older to possess and to privately use, possess, manufacture, give away, or transport 1 ounce of

marijuana and grow up to 6 marijuana plants;

(3) creates a system in which licensed businesses can produce and sell marijuana;

(4) establishes a Department of Marijuana Licenses & Control (including a 7-member board appointed by the governor) to regulate the cultivation,

manufacturing, testing, transportation, and sale of marijuana; and

(5) provides local governments with the authority to regulate marijuana businesses.

Background: Prop 205 was added to the Arizona ballot after proponents sub- mitted more than 177,000 qualifying signatures and defeated a legal challenge pre- sented in Arizona Supreme Court. What many don’t know (or may not remember) is that Arizonans previously passed an initiative in 1996 — to legalize marijuana and reduce criminal penalties by allowing probation instead of prison for non-violent possession cases — by a 65% margin. However, the Arizona legislature overturned it the following year by passing a bill that essentially gutted the voter-approved law.

In retaliation, Arizonans rallied in 1998 to pass the Voter Protection Act, which ensures legislators can’t reverse initiatives or referendums approved by voters, nor can they be vetoed by the governor. After a few more failed attempts, medical mari- juana legalization was finally passed in 2010. The state currently has around 100,000 medical marijuana patients and 100 licensed dispensaries in operation.

There are currently four resolutions in the Arizona House that would undermine Prop. 205’s provisions. In particular is HCR 2024, proposed by Rep. Bob Thorpe (Flagstaff). This resolution would require any initiatives that support “legal use of drugs” classified as “illegal under federal law” to be passed by a three-fifths major- ity of voters, rather than just a “simple majority” as provided under current law. All of the proposals in the House are currently resolutions, not bills, which mean they would also require voter approval, likely in a future special election.

Supporters say: if recreational marijuana is legalized, drug cartels will be re- placed by licensed businesses, who will be regulated for quality control of their product, resulting in less risk of additives that appear in the current unregulated market. Legal distributors will also be required to ask for ID, which will ensure sales only to adults of legal age. Law enforcement would be less burdened, as po- lice would be able to spend more time focusing on dangerous crimes rather than non-violent marijuana possession cases. Prison overcrowding would be reduced, as the Act will eliminate mandatory prison terms for instances of simple posses- sion. Taxation on products would provide money for the state, estimated at “$123 million in annual revenue, including $55 million per year for K-12 education.”

Opponentssay: thelawwillcreatea“BigMarijuana”corporatepresencesimilar to “Big Tobacco.” Provisions in the initiative would also create additional bureaucra- cies to regulate the industry resulting in increased administrative costs to the state. Marijuana companies may target kids by producing the drug in kid-friendly forms such as gummy candies and chocolates. Revenue gains may not occur as estimated, as the costs of drug treatment programs and “bigger government” negate any in- come generated by legalizing and regulating marijuana.

Proposition 206:

The Fair Wages & Healthy Families Act

Prop 205 increases minimum wage to $10 in 2017 then gradually to $12 by 2020; provides 40 hours annual “earned paid

sick time” for employees of large employers, 24 hours for those of small employers; time accrues at one hour earned for every 30 hours worked;

time may be used to address circumstances caused by illness of employee or employee’s family, public health emergencies, or domestic

violence; prohibits retaliating against employees using the benefit; allows for more generous paid time-off policies; and exempts employees who expressly waive the benefit under collective bargaining agreements.

Background: Prop 206 was added to the ballot after proponents submit- ted more than 176,000 qualifying signatures and defeated a legal challenge presented — by the Arizona Chamber of Commerce & Industry and the Arizona Restaurant Association — in Arizona Supreme Court. In 2006, voters passed the Arizona Minimum Wage Act, which created a minimum wage of $6.75 per hour, an increase over the then-federally mandated $5.15 per hour rate. That initiative guaranteed cost-of-living increases and rede- fined the employer-employee relationship in some cases. And similarly to 1996’s Prop 200, the Arizona legislature recently passed two bills that at- tempt to change the definition of wages and prevent local governments from ratifying rules regarding paid time off. Though these bills are likely unconstitutional under the Voter Protection Act, Prop 206 thwarts these at- tempted changes.

In 2009, the federal government raised the minimum wage to $7.25 per hour. Arizona’s minimum wage is now $8.05 per hour and, under current law, it is expected to rise to $8.15 per hour in 2017. There is much debate among politicians and economists as to the effects of minimum wage hikes, both short- and long-term. Two states raised their minimum wage in De- cember 2015; 15 others have done so since the beginning of 2016; all but one has a minimum wage in excess of Arizona’s current rate.

Supporters say: a higher minimum wage will allow families with full-time working adults to rise above poverty levels, providing stimulus to Arizona’s economy by increasing the spending power and morale of low-wage work- ers and families, decreasing public welfare costs for the state, and reducing the costs of high-turnover hiring and training.

Opponents say: unemployment will rise because businesses will elimi- nate jobs and reduce employee hours due to the increase in payroll costs; companies will be encouraged to pursue increased automation; and small businesses may be less able to absorb the costs of paid sick time; all of which leads to increases in the price of goods and services.